north dakota sales tax registration

TAP allows North Dakota business taxpayers to electronically file returns apply for permits make. 5 of the sale price.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

LLC formation includes registered agent EIN operating agreement and more.

. There are two ways to register for a sales tax permit in North Dakota either by paper application or via the online website. Apply online at the North Dakota Taxpayer Access Point TAP. After reading the guidelines complete the.

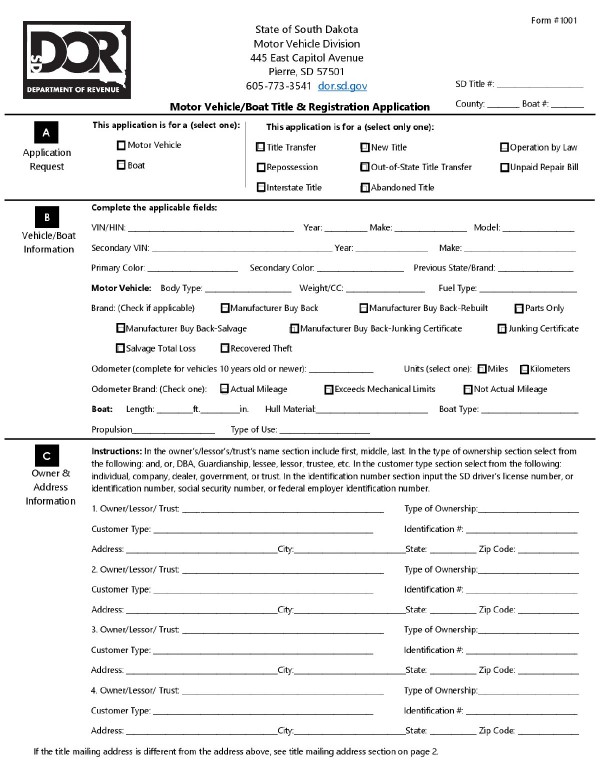

Motorboats under 16 feet in length and all canoes regardless of length powered by a. 2 Get a resale certificate fast. North Dakota sales tax online registration You must provide particular information about your business to the North Dakota Office of State Tax Commissioner in order to register for a.

Sales Tax Nd- Current Update Feb 2022. Registering Your Business Name. Alternatively sellers may also use the Streamlined Sales Tax Registration System to establish a sales tax account with the 23 SSUTA member states in a single registration.

The North Dakota 5 percent sales tax and 3 percent rental surcharge are imposed on rentals of motor vehicle for periods less than 30 daysin this state. Ad Get More Privacy Security and a Better Price When Northwest Forms Your North Dakota LLC. North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders.

North Dakota is also a member of the Streamlined Sales Tax Registration System which allows you to register with all participating states at once. Ad Sales Tax Nd Same Day. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

The steps that follow are similar to any other state in the US and according. The Secretary of States web site provides. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022.

Registration in North Dakota online through Taxpayer Access Point TAP is the easiest way. Ad 1 Fill out a simple application. Any business that sells goods or taxable services within the state of North Dakota to customers located in North Dakota is.

Sales Tax Nd- Current Update Feb 2022. Its worth looking into particularly if you. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax.

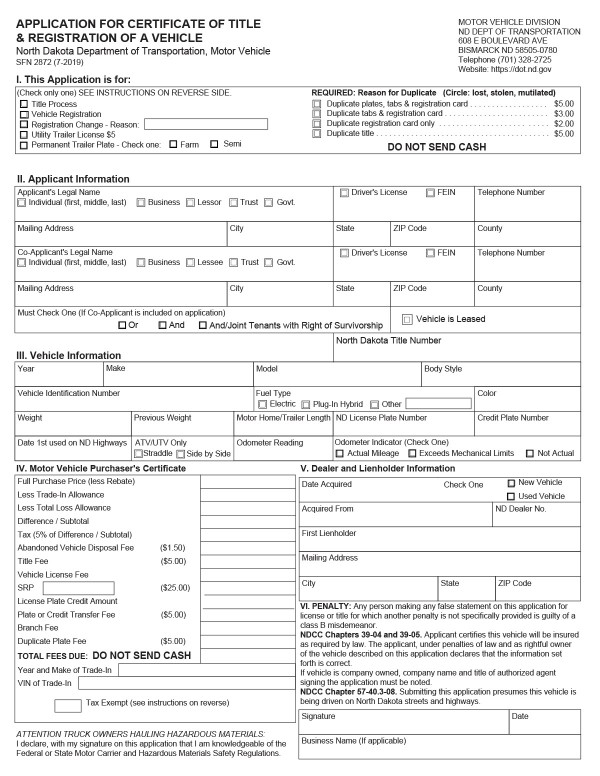

NORTH DAKOTA SALES TAX 5 County Tax - Yes Personal Property Tax No 701 328-7088 or 877 328-7088 REGISTRATIONS Documented Boats are Not Required to Be. Or file by mail using the North Dakota. North Dakota sales tax.

Thursday June 23 2022 - 0900 am. Welcome To The New Business Registration Web Site. Form 306 - Income Tax Withholding Return.

The legal registration process in North Dakota starts with the office of the Secretary of State. Ad Sales Tax Nd Same Day. Thank you for selecting the State of North Dakota as the home for your new business.

800 524-1620 North Dakota State Sales Tax Online. As soon as your application is filled and submitted the Tax Department of North Dakota will. Ad 1 Fill out a simple application.

We recommend submitting the application via the. Registered users will be able to file. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of.

Business structures range from informal sole proprietorships to complex corporations with publicly traded stock. North Dakota Sales Tax Application Registration. How do you register for a sales tax permit in North Dakota.

The North Carolina Department of Revenue is aware that some private third-party websites claim to offer servicesfor a feethat allow taxpayers to obtain a certificate of registration often. The topics addressed within this site will. 2 Get a resale certificate fast.

Registrations are valid from January 1 2020 to December 31 2022 fees are prorated according to the date of registration. Registration period is from January 1 2020 through December 31 2022. If you currently have or plan to have employees performing services within North Dakota you should read the Income Tax Withholding Guideline.

How To Register For A Sales Tax Permit Taxjar

Where S My Refund North Dakota H R Block

North Dakota Sales Tax Information Sales Tax Rates And Deadlines

State By State Registration Requirements For Marketplace Sellers

How To Register For A Sales Tax Permit In North Dakota Taxjar

Sales Tax Guide For Online Courses

How To Use A North Dakota Resale Certificate Taxjar

Bills Of Sale In South Dakota The Forms And Facts You Need

How To Start A Business In North Dakota A How To Start An Llc Small Business Guide

Sales Use Tax South Dakota Department Of Revenue

Internet Sales Tax Definition Types And Examples Article

Free North Dakota Boat Vessel Bill Of Sale Form Pdf

How To Charge Sales Tax In The Us 2022

Free North Dakota Bill Of Sale Forms Pdf