unrealized capital gains tax bill

Taxing unrealized gains at death while still levying the estate tax further compounds the total tax burden on saving and investment which may be the highest tax burden on capital. For gains between 80000 and 496600 the rate is 15 and for long term capital gains over 496600 the rate is 20.

Short-term capital gains and losses are those realized from the sale of investments that you have owned for 1 year or less.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory assetThe most common capital gains are realized from the sale of stocks bonds precious metals real estate and property. For joint filers Adjusted Gross Income below 80000 the capital gain tax rate is 0. Net gains from the sale of shares held for more than one year.

The top tax rate on income earned from labor is 37 but the tax on capital gains is a lower 20 and that favors those with extreme wealth. But there are some important details to know as you see how tax-loss harvesting might help lower your tax bill. In fact thats one reason why policymakers created the estate tax in 1916.

The capital gains tax on most net gains is no more than 15 percent for most people. 2016-08-11 114 Comments by Cherry Tags. Cherry Chan CPA CA.

Not all countries impose a capital gains tax and most have different rates of taxation for individuals and corporations. Short-term versus long-term gains and losses. Long-term capital gains and losses.

Capital gain taxes can be reduced by any capital assets that you own that already have unrealized capital losses such as loss on any stock or mutual funds in any unregistered accounts. As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket. If your taxable income is less than 80000 some or all of your net gain may even be taxed at zero percent.

Much of the money that wealthy heirs inherit would never face any taxation were it not for the estate tax. Increasing the top capital gains tax rate to 434 percent alone would mean high-earning taxpayers may face tax rates north of 50 percent on capital gains when including state taxes. Create a Tax on Net Worth the Billionaire Tax A.

Capital gains taxes are no longer tied to your ordinary income tax bracket but instead now have their own individual brackets. May include some distributions received from investments held by the fund. Democrats also considered an increase to top long-term capital gains tax rates from 20 to 25.

The Largest Estates Consist Mostly of Unrealized Capital Gains That Have Never Been Taxed Figure 4. There are 2 types of gains and losses. Share Chart on Facebook Share Chart on Twitter.

Until next time happy Canadian Real Estate Investing and enjoy the heat. Subject to the capital gains rates usually lower than the ordinary income tax rates. A method of crystallizing capital losses by selling losing positions and purchasing companies within similar industries that have similar fundamentals.

This means that the gap in tax rates would be narrowed but not closed under the Ways and Means bill. The lower capital gains rate can also encourage more. Your real estate accountant.

Net gains from the sale of shares held for one year or less. To serve as a backstop to the. The bill recently approved by the House Ways and Means Committee would effectively set the top rate for capital gains at 28 percent including a top income tax rate of 25 percent for capital gains plus a 3 percent surcharge on all income beyond 5 million.

The Billionaire Tax Proposal A No Good Awful Terrible Idea Youtube

How To Reduce Capital Gains Tax Liability For The Year

Capital Gains Yield Cgy Formula Calculation Example And Guide

How Much Does A Comprehensive Financial Plan Actually Cost Https Www Kitces Com Blog Average Financial Plan Fee H How To Plan Financial Planning Financial

High Class Problem Large Realized Capital Gains Montag Wealth

I Chose This Image To Represent Management Operating Agreements This Image Displays That An External Management Compan Management Company Management Incentive

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

Long Term Capital Gain Tax On Shares Learn By Quickolearn By Quicko

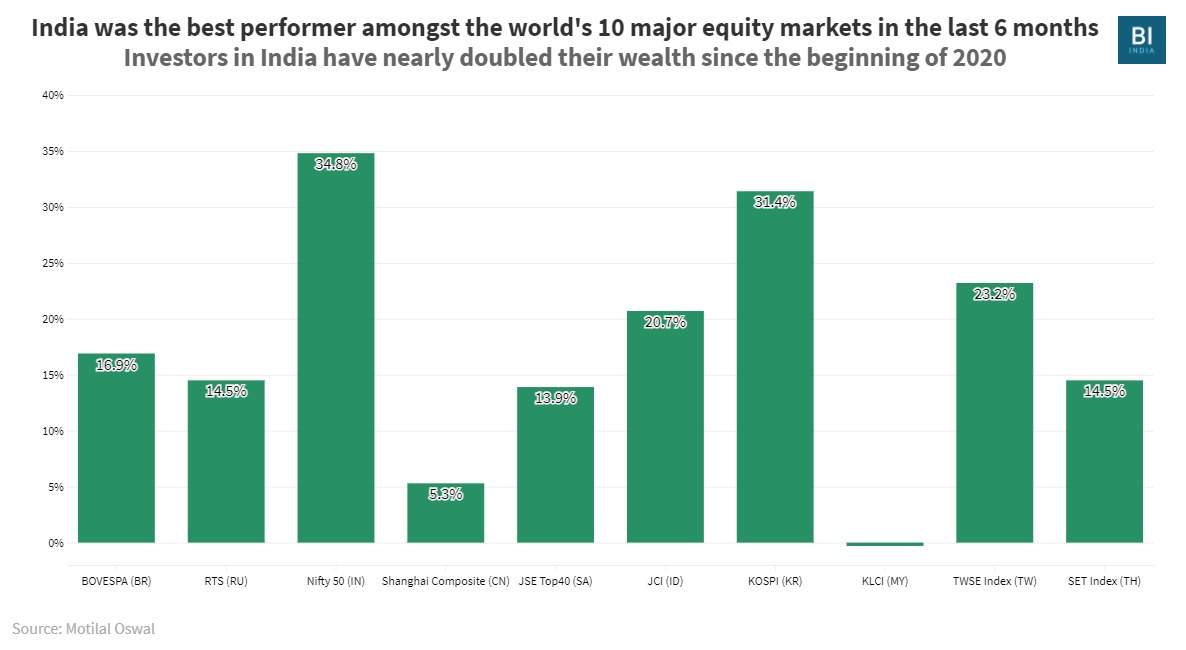

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Bitcoin Gains Can Become Tax Free Cryptocurrency Investing In Cryptocurrency Bitcoin

How To Calculate Capital Gains On Sale Of Gifted Property Examples

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)