how to file back taxes yourself

You will not receive duplicates of any W-2s 1099s or 1098s but. If you need supporting evidence for income earned and deductions file.

Prior Year Tax Return Software File Previous Year Taxes With Freetaxusa

Youll need to have handy your Social Security number or individual taxpayer.

. Most self-employed people will be obliged to make anticipated. 800-829-1040 individuals or 800-829-4933 businesses. Filing Back Taxes.

Remember you can file back taxes with the IRS at any time but if you want to claim. Get relief from the IRS. Get Help with Your Back Taxes Owed in NYC.

If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. Make sure you keep a copy for yourself. The IRS may file a return for you.

If you want to find out the status of your past-due tax return you can call the IRS at 800-829-1040. So it makes sense to file your back taxes if it means a refund will come your way. To get your tax return started youll first need to find out how much money you made in 2021.

Piscataway NJ location our staff is ready to help you today. If you owe less than 250000 you can set up a payment plan over the phone at. Whether you owe a few thousand dollars or more.

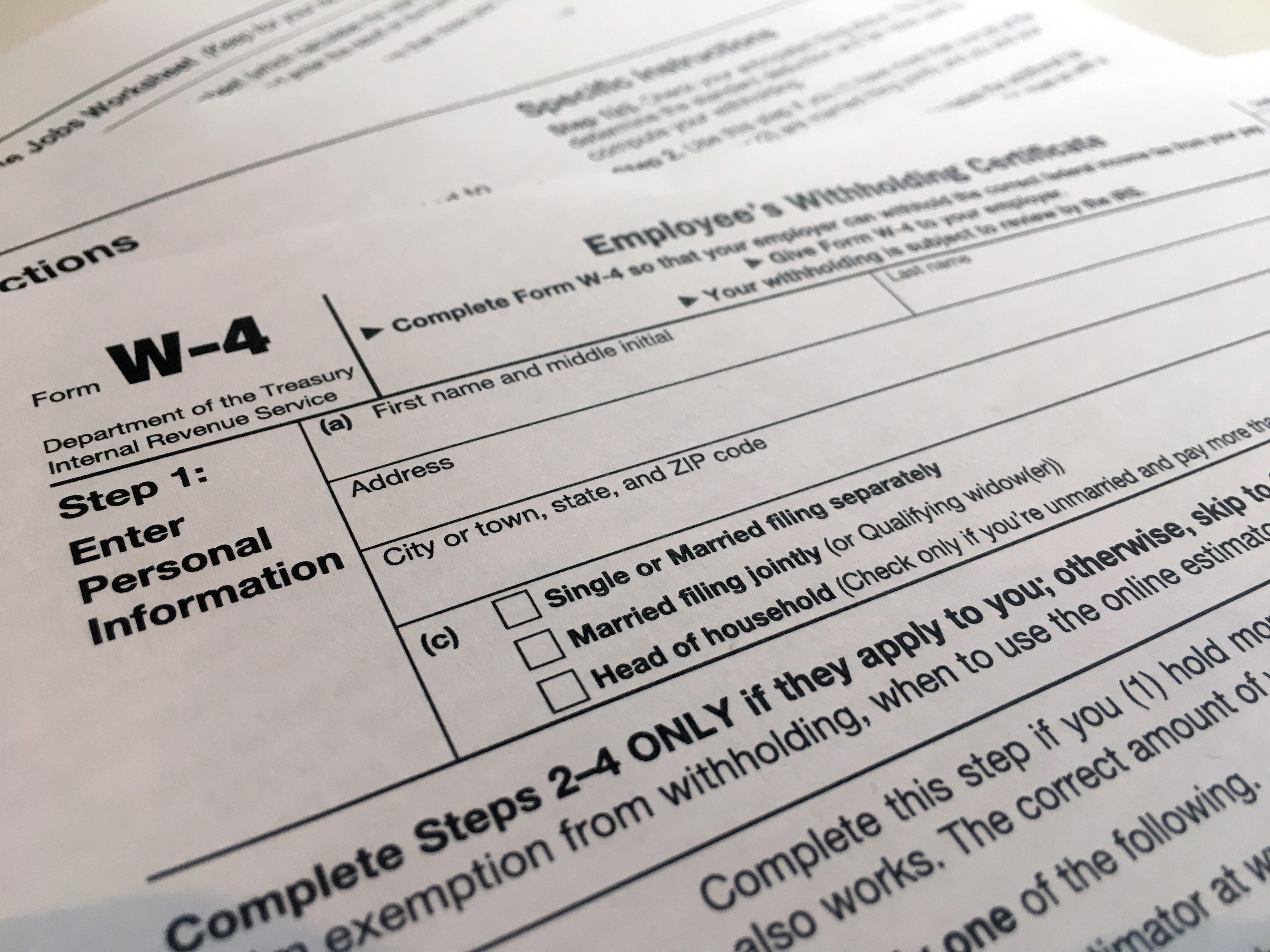

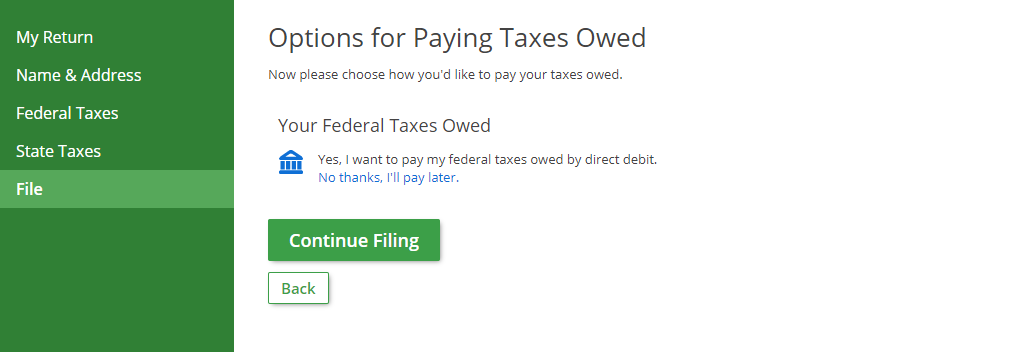

Simply fill out the form and submit it online. Determine how youll file your back taxes. File in an Office File Online Yourself See all Ways to File Taxes.

At our 1303 Centennial Ave. The objective is to pay enough every quarter so that you wont owe too much in taxes on April 18 when you file your tax return. Be prepared to pay fees or penalties.

SuperPages SM - helps you find the right local businesses to meet your specific needs. The other side can tell the movant and the court why he or she thinks that the movant should not get what he or she. If you want to tackle filing your back taxes by yourself choose a reputable tax software company to assist you.

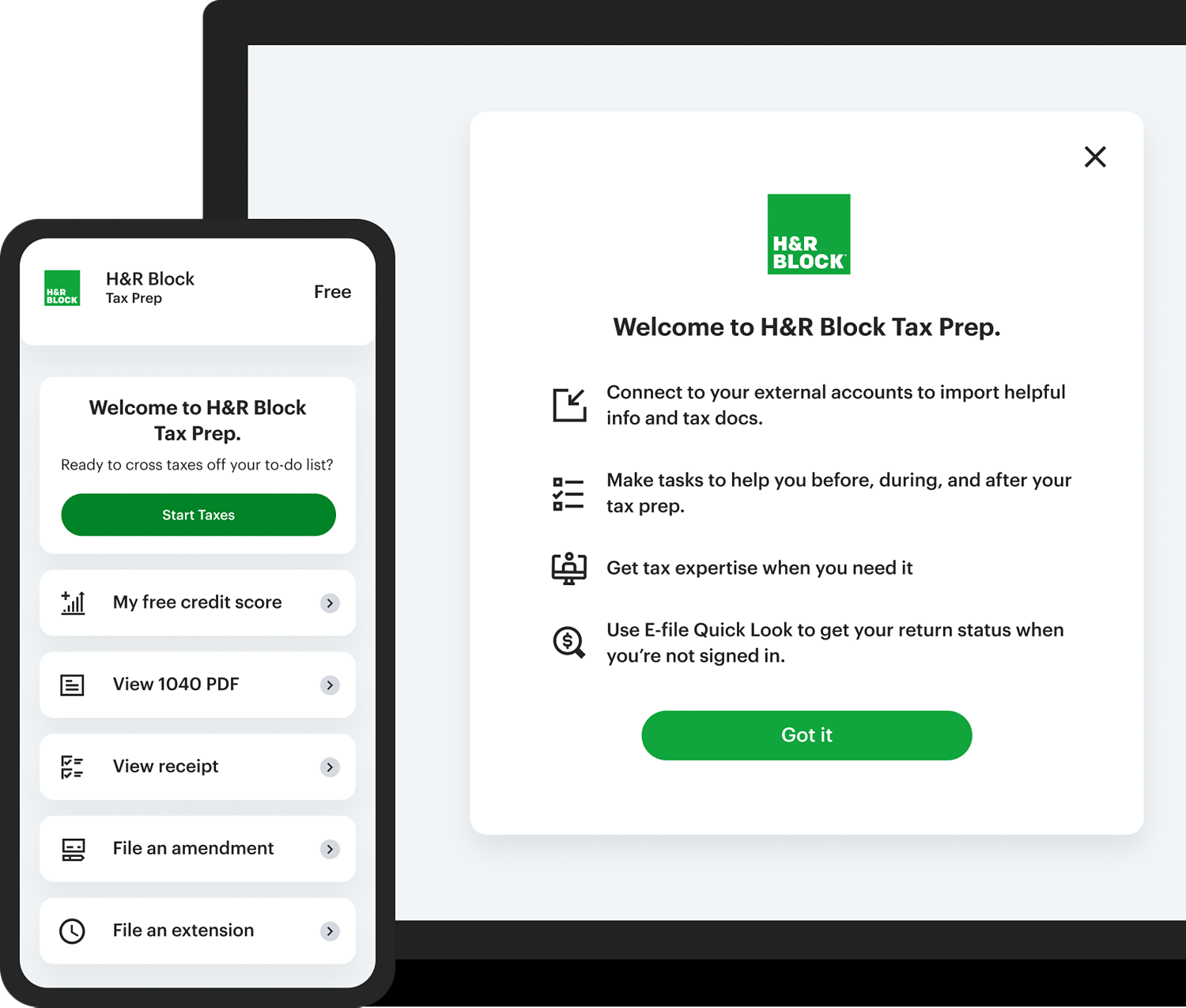

If you choose this email link and qualify you will not be charged for preparation and e-filing of a federal tax return. File your taxes at Jackson Hewitt. To file back taxes youll need to purchase the edition of HR Blocks software.

If you owe more than 250000 your. It takes about six weeks for the IRS to process accurately completed back tax returns. You file past due returns in the same manner that you would file a return that is on time.

Since tax laws change year. Alternatively print it fill it out and mail it to the address indicated. Remember tax refunds are essentially interest-free loans you make to the government.

Search results are sorted by a combination of factors to give you a set of choices in response to your. Is ready to work with you to handle all of your back taxes owed to the IRS. No unfortunately the HR Block Online program is only designed to be used for the current years returns.

The IRS began accepting and processing federal tax returns on January 24 2022. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. Fees to file your federal return are prohibited.

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

How To File Back Taxes Past Years Tax Returns Picnic Tax

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Income Tax Filing Deadline Pushed Back Eagle Country 99 3

Oc Free Tax Prep Irs Certified Volunteers Available

What Is The Best Tax Software 2022 Winners

How To File Your Taxes In Portland Oregon Cccu

Free Online Tax Filing E File Tax Prep H R Block

Filing A Tax Return For A Family Member Or Someone Other Than Yourself The Official Blog Of Taxslayer

What If I Can T Pay My Taxes What To Know

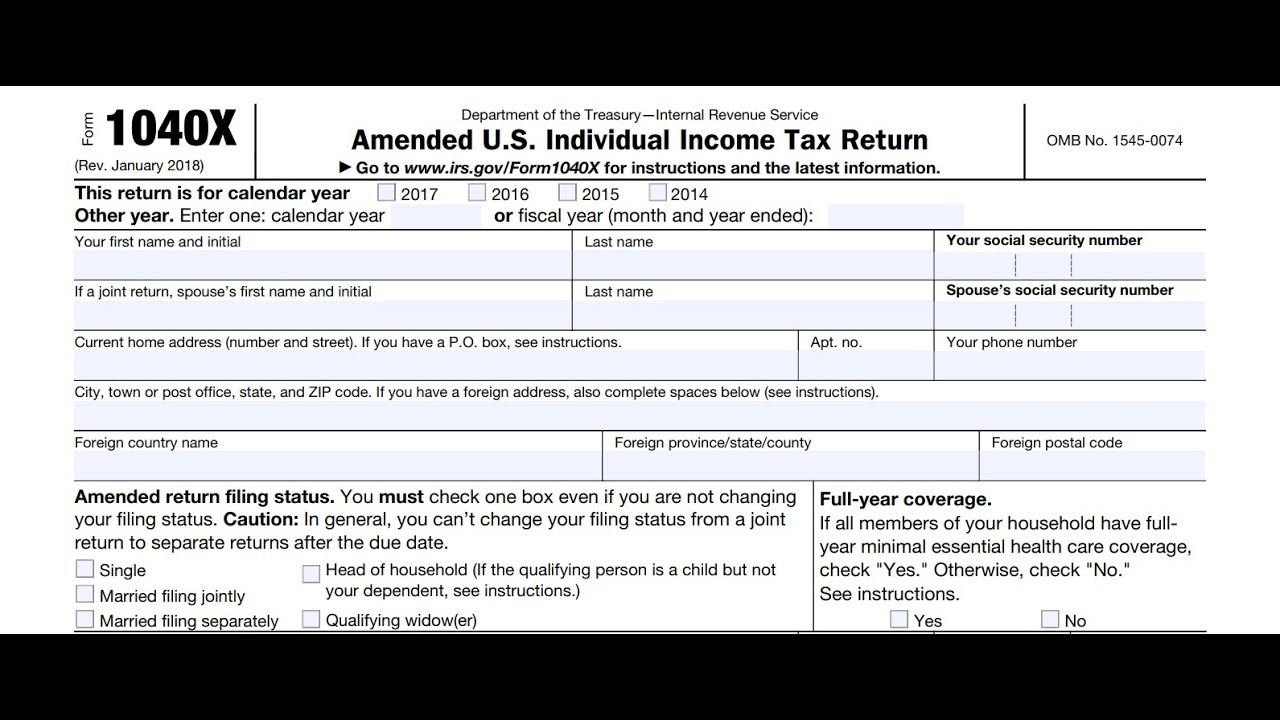

Prepare And File Irs 1040 X Income Tax Return Amendment

How To Pay Taxes As A Freelancer

1040 2021 Internal Revenue Service

How To File Your Taxes In 5 Simple Steps Ramsey

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check